Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages? for Beginners

NCUSIF maintained a strong balance of $1. 23 per $100 in insured deposits versus an unfavorable $0. 39 per $100 in insured deposits at the FDIC. Hence, via the Troubled Property Relief Program (TARPAULIN), the federal government offered emergency situation loans totaling $236 billion to 710 banksor 1. 93% of all bank properties.

008% of cooperative credit union possessions. While there are numerous factors credit unions didn't engage in the exact same kind of subprime loaning as home loan business and banks, credit unions' distinct structure is the main reason. As not-for-profit, member-owned entities, cooperative credit union have significantly less rewards to look for short-term earnings and rewards that clearly aren't in their members' benefits.

Increasing home prices, falling home loan rates, and more effective refinancing drew masses of property owners to refinance their houses and extract equity at the very same time, increasing systemic threat in the financial system. 3 trends in the U.S. real estate market combined to dramatically magnify the losses of homeowners in between 2006 and 2008 and to increase the systemic danger in the monetary system.

But together, they tempted masses of property owners to refinance their houses and extract equity at the exact same time (" cash-out" refinancing), increasing the danger in the financial system, according to,, and. Like a ratchet tool that could just adjust in one instructions as home costs were increasing, the system was unforgiving when prices fell.

The Buzz on How Is The Compounding Period On Most Mortgages Calculated

$115362), these scientists approximate that this refinancing cog effect might have generated prospective losses of $1. 5 trillion for home loan loan providers from June 2006 to December 2008; more than 5 times the possible losses had homeowners avoided all those cash-out refinancing offers. Over the previous twenty years, the development and increasing effectiveness of the refinancing service have made it simpler for Americans to benefit from falling rate of interest and/or rising house worths.

These authors focus on the formerly unstudied interaction of this development in refinancing with falling interest rates and rising home worths. Benign in isolation, the 3 patterns can have explosive outcomes when they take place all at once. We show that refinancing-facilitated home-equity extractions alone can account for the remarkable boost in systemic threat postured by the U.S.

Using a design of the home mortgage market, this research study finds that had there been no cash-out refinancing, the overall worth of home loans impressive by December 2008 would have reached $4,105 billion on genuine estate worth $10,154 billion for an aggregate loan-to-value ratio of about 40 percent. With cash-out refinancing, loans ballooned to $12,018 billion on home worth $16,570 for a loan-to-value ratio of 72 percent.

Initially, regular cash-out refinancing altered the regular mix of mortgage-holders and produced an unintended synchronization of homeowner take advantage of and home loan duration, triggering associated defaults when the issue hit. Second, as soon as a house is bought, the debt can't be incrementally minimized due to the fact that house owners can't sell parts of their house-- houses are indivisible and the house owner is the sole equity holder in the house.

The Buzz on What Percentage Of People Look For Mortgages Online

With home worths falling from the peak of the market in June 2006, the study's simulation suggests that some 18 percent of houses remained in negative-equity territory by December 2008. Without cash-out refinancing, that figure would have been only 3 percent. The most perilous aspect of this phenomenon is its origin in 3 benign market conditions, each of which is usually considered a precursor of economic growth, the authors write. what happened to cashcall mortgage's no closing cost mortgages.

Although it is the quality and substance of policy that needs to be the center of any debate concerning regulation's function in the monetary crisis, a direct procedure of guideline is the financial dollars and staffing levels of the financial regulatory agencies. what do i do to check in on reverse mortgages. In a Mercatus Center research study, Veronique de Rugy and Melinda Warren discovered that outlays for banking and monetary guideline increased from only $190 million in 1960 to $1.

3 billion in 2008 (in continuous 2000 dollars). Focusing specifically on the Securities and Exchange Commission the firm at the center of Wall Street policy spending plan investments under President George W. Bush increased in genuine terms by more than 76 percent, from $357 million to $629 million (2000 dollars). However, spending plan dollars alone do not always equate into more police officers on the beat all those extra dollars could have been invested on the SEC's lavish brand-new headquarters structure.

The SEC's 2008 staffing levels are more than 8 times that of the Customer Item Security Commission, for example, which reviews countless customer products each year. Similar figures for bank regulatory agencies reveal a small decline from 13,310 in 2000 to 12,190 in 2008, although this is driven entirely by decreases in personnel at the local Federal Reserve Banks, arising from modifications in their checkclearing activities (primarily now done electronically) and at the FDIC, as its resolution personnel handling the bank failures of the 1990s was wound down.

5 Easy Facts About What Percentage Of National Retail Mortgage Production Is Fha Insured Mortgages Described

Another procedure of policy is the outright number of rules provided by a department or company. The primary monetary regulator, the Department of the Treasury, which includes both the Office of the Comptroller of the Currency and the Office of Thrift Supervision, saw its yearly average of brand-new guidelines proposed boost from around 400 in the 1990s to more than 500 in the 2000s.

Reserving whether bank and securities regulators were doing their tasks aggressively or not, one thing is clear current years have witnessed an increasing variety of regulators on the beat and an increasing variety of regulations. Central to any claim that deregulation caused the crisis is the GrammLeachBliley Act. The core of GrammLeachBliley is a repeal of the New Dealera GlassSteagall Act's prohibition on the blending of investment and business banking.

They typically also have large trading operations where they buy and offer monetary securities both on behalf of their customers and on their own account. Business banks accept guaranteed deposits and make loans to households and services. The deregulation critique posits that once Congress cleared the way for financial investment and business banks to combine, the financial investment banks were provided the reward to take greater threats, while reducing the amount of equity they are required to hold against any given dollar of assets.

Even before its passage, financial investment banks were currently enabled to trade and hold the extremely monetary possessions at the center of the monetary crisis: mortgagebacked securities, derivatives, creditdefault swaps, collateralized financial obligation obligations. The shift of financial investment banks into holding considerable trading portfolios arised from their increased https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA capital base as an outcome https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group of a lot of financial investment banks ending up being openly held business, a structure permitted under GlassSteagall.

The Best Guide To The Big Short Who Took Out Mortgages

NCUSIF retained a strong balance of $1. 23 per $100 in insured deposits versus a negative $0. 39 per $100 in insured deposits at the FDIC. Thus, via the Distressed Asset Relief Program (TARP), the federal government supplied emergency loans amounting to $236 billion to 710 banksor 1. 93% of all bank assets.

008% of credit union properties. While there are numerous factors credit unions didn't engage in the same type of subprime financing as mortgage companies and banks, cooperative credit union' unique structure is the primary reason. As not-for-profit, member-owned entities, credit unions have considerably less incentives to look for short-term profits and bonuses that clearly aren't in their members' best interests.

Increasing house costs, falling home mortgage rates, and more efficient refinancing drew masses of house owners to refinance their homes and extract equity at the exact same time, increasing systemic risk in the financial system. Three trends in the U.S. housing market combined to dramatically amplify the losses of homeowners between 2006 and 2008 and to increase the systemic risk in the financial system.

However together, they tempted masses of house owners to refinance their homes and extract equity at the same time (" cash-out" refinancing), increasing the danger in the monetary system, according to,, and. Like a ratchet tool that could only change in one instructions as home rates were increasing, the system was unforgiving when prices fell.

How How Many Housing Mortgages Defaulted In 2008 can Save You Time, Stress, and Money.

$115362), these scientists estimate that this refinancing cog impact could have produced prospective losses https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA of $1. 5 trillion for home mortgage loan providers from June 2006 to December 2008; more than 5 times the prospective losses had homeowners avoided all those cash-out refinancing offers. Over the past twenty years, the growth and increasing efficiency of the refinancing company have made it simpler for Americans to benefit from falling rate of interest and/or increasing home values.

These authors focus on the formerly unstudied interaction of this development in refinancing with falling rate of interest and increasing house values. Benign in isolation, the three patterns can have explosive outcomes when they take place all at once. We reveal that refinancing-facilitated home-equity extractions alone can represent the remarkable boost in systemic threat posed by the U.S.

Utilizing a design of the home mortgage market, this research study discovers that had there been no cash-out refinancing, the total worth of mortgages impressive by December 2008 would have reached $4,105 billion on realty worth $10,154 billion for an aggregate loan-to-value ratio of about 40 percent. With cash-out refinancing, loans ballooned to $12,018 billion on home worth $16,570 for a loan-to-value ratio of 72 percent.

Initially, frequent cash-out refinancing altered the regular mix of mortgage-holders and developed an unintended synchronization of property owner leverage and home mortgage period, causing associated defaults when the issue hit. Second, as soon as a home is purchased, the financial obligation can't be incrementally lowered because homeowners can't sell portions of their home-- homes are indivisible and the homeowner is the sole equity holder in the house.

The Single Strategy To Use For What Are The Interest Rates On 30 Year Mortgages Today

With home worths falling from the peak of the marketplace in June 2006, the research study's simulation recommends that some 18 percent of houses were in negative-equity area by December 2008. Without cash-out refinancing, that figure would have been only 3 percent. The most insidious element of this phenomenon is its origin in 3 benign market conditions, each of which is normally thought about a harbinger of economic growth, the authors write. what do i need to know about mortgages and rates.

Although it is the quality and substance of regulation that has to be the center of any dispute concerning policy's function in the financial crisis, a direct measure of guideline is the financial dollars and staffing levels of the monetary regulatory companies. mortgages what will that house cost. In a Mercatus Center research study, Veronique de Rugy and Melinda Warren discovered that investments for banking and financial regulation increased from just $190 million in 1960 to $1.

3 billion in 2008 (in continuous 2000 dollars). Focusing specifically on the Securities and Exchange Commission the company at the center of Wall Street regulation budget investments under President George W. Bush increased in real terms by more than 76 percent, from $357 million to $629 million (2000 dollars). Nevertheless, spending plan dollars alone do not always equate into more cops on the beat all those extra dollars could have been spent on the SEC's extravagant brand-new head office building.

The SEC's 2008 staffing levels are more than 8 times that of the Consumer Item Safety Commission, for instance, which reviews thousands of customer items yearly. Similar figures for bank regulative agencies show a minor decline from 13,310 in 2000 to 12,190 in 2008, although this is driven totally by decreases in staff at the local Federal Reserve Banks, arising from changes in their checkclearing activities (mostly now done digitally) and at the FDIC, as its resolution personnel handling the bank failures of the 1990s was wound down.

The 10-Second Trick For How Do Balloon Fixed Rate Mortgages Work?

Another step of policy is the outright number of rules issued by a department or company. The main financial regulator, the Department of the Treasury, that includes both the Office of the Comptroller of the Currency and the Workplace of Thrift Guidance, saw its yearly average of brand-new guidelines proposed increase from around 400 in the 1990s to more than 500 in the 2000s.

Reserving whether bank and securities regulators were doing their jobs strongly or not, something is clear recent years have experienced an increasing https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group variety of regulators on the beat and an increasing number of guidelines. Central to any claim that deregulation caused the crisis is the GrammLeachBliley Act. The core of GrammLeachBliley is a repeal of the New Dealera GlassSteagall Act's restriction on the mixing of financial investment and business banking.

They frequently also have big trading operations where they purchase and sell financial securities both on behalf of their customers and by themselves account. Commercial banks accept insured deposits and make loans to households and organizations. The deregulation critique posits that once Congress cleared the method for financial investment and commercial banks to merge, the financial investment banks were offered the incentive to take higher risks, while minimizing the quantity of equity they are needed to hold versus any offered dollar of possessions.

Even prior to its passage, investment banks were currently allowed to trade and hold the very financial assets at the center of the monetary crisis: mortgagebacked securities, derivatives, creditdefault swaps, collateralized debt obligations. The shift of financial investment banks into holding substantial trading portfolios arised from their increased capital base as a result of the majority of investment banks ending up being publicly held companies, a structure permitted under GlassSteagall.

The Best Strategy To Use For How Is Mortgages Priority Determined By Recording

NCUSIF retained a strong balance of $1. 23 per $100 in insured https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA deposits versus a negative $0. 39 per $100 in insured deposits at the FDIC. Therefore, via the Struggling Asset Relief Program (TARP), the government provided emergency situation loans totaling $236 billion to 710 banksor 1. 93% of all bank possessions.

008% of cooperative credit union assets. While there are numerous reasons credit unions didn't participate in the very same sort of subprime financing as home mortgage business and banks, credit unions' unique structure is the main factor. As not-for-profit, member-owned entities, credit unions have significantly less incentives to look for short-term earnings and benefits that clearly aren't in their members' best interests.

Rising house rates, falling home mortgage rates, and more effective refinancing tempted masses of homeowners to re-finance their homes and extract equity at the exact same time, increasing systemic threat in the financial system. 3 patterns in the U.S. real estate market integrated to considerably amplify the losses of property owners in between 2006 and 2008 and to increase the systemic threat in the financial system.

But together, they enticed masses of homeowners to refinance their homes and extract equity at the exact same time (" cash-out" refinancing), https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group increasing the threat in the monetary system, according to,, and. Like a ratchet tool that might only change in one direction as house prices were rising, the system was unforgiving when rates fell.

8 Easy Facts About What Percentage Of National Retail Mortgage Production Is Fha Insured Mortgages Shown

$115362), these researchers approximate that this refinancing ratchet effect could have produced prospective losses of $1. 5 trillion for home mortgage loan providers from June 2006 to December 2008; more than five times the prospective losses had homeowners avoided all those cash-out refinancing deals. Over the past twenty years, the development and increasing effectiveness of the refinancing business have made it much easier for Americans to benefit from falling rate of interest and/or rising house values.

These authors focus on the formerly unstudied interaction of this development in refinancing with falling rates of interest and rising home values. Benign in isolation, the three trends can have explosive outcomes when they happen concurrently. We show that refinancing-facilitated home-equity extractions alone can account for the remarkable increase in systemic danger posed by the U.S.

Using a model of the mortgage market, this research study finds that had there been no cash-out refinancing, the total value of home loans outstanding by December 2008 would have reached $4,105 billion on real estate worth $10,154 billion for an aggregate loan-to-value ratio of about 40 percent. With cash-out refinancing, loans swelled to $12,018 billion on property worth $16,570 for a loan-to-value ratio of 72 percent.

Initially, frequent cash-out refinancing altered the typical mix of mortgage-holders and produced an unintended synchronization of homeowner take advantage of and mortgage period, triggering correlated defaults when the issue hit. Second, once a house is bought, the debt can't be incrementally lowered since house owners can't sell off parts of their home-- houses are indivisible and the house owner is the sole equity holder in the house.

The Ultimate Guide To What Metal Is Used To Pay Off Mortgages During A Reset

With home worths falling from the peak of the marketplace in June 2006, the research study's simulation suggests that some 18 percent of homes remained in negative-equity area by December 2008. Without cash-out refinancing, that figure would have been just 3 percent. The most perilous aspect of this phenomenon is its origin in three benign market conditions, each of which is normally considered a harbinger of economic growth, the authors write. how is the compounding period on most mortgages calculated.

Although it is the quality and compound of policy that needs to be the center of any debate concerning regulation's role in the financial crisis, a direct measure of regulation is the monetary dollars and staffing levels of the monetary regulatory companies. who took over abn amro mortgages. In a Mercatus Center research study, Veronique de Rugy and Melinda Warren discovered that expenses for banking and financial regulation increased from just $190 million in 1960 to $1.

3 billion in 2008 (in constant 2000 dollars). Focusing particularly on the Securities and Exchange Commission the agency at the center of Wall Street guideline spending plan expenses under President George W. Bush increased in real terms by more than 76 percent, from $357 million to $629 million (2000 dollars). Nevertheless, budget dollars alone do not always equate into more polices on the beat all those additional dollars could have been invested on the SEC's lavish brand-new headquarters structure.

The SEC's 2008 staffing levels are more than eight times that of the Customer Item Security Commission, for instance, which examines countless customer items yearly. Similar figures for bank regulatory agencies reveal a minor decrease from 13,310 in 2000 to 12,190 in 2008, although this is driven totally by reductions in personnel at the regional Federal Reserve Banks, arising from modifications in their checkclearing activities (primarily now done digitally) and at the FDIC, as its resolution personnel handling the bank failures of the 1990s was wound down.

The Definitive Guide for There Are Homeless People Who Cant Pay There Mortgages

Another procedure of policy is the absolute number of rules released by a department or company. The main monetary regulator, the Department of the Treasury, which consists of both the Workplace of the Comptroller of the Currency and the Workplace of Thrift Supervision, saw its yearly average of brand-new rules proposed boost from around 400 in the 1990s to more than 500 in the 2000s.

Setting aside whether bank and securities regulators were doing their jobs strongly or not, something is clear recent years have actually witnessed an increasing number of regulators on the beat and an increasing number of regulations. Central to any claim that deregulation triggered the crisis is the GrammLeachBliley Act. The core of GrammLeachBliley is a repeal of the New Dealera GlassSteagall Act's prohibition on the blending of financial investment and business banking.

They frequently likewise have big trading operations where they purchase and offer financial securities both on behalf of their customers and by themselves account. Commercial banks accept guaranteed deposits and make loans to homes and services. The deregulation review presumes that as soon as Congress cleared the method for financial investment and business banks to merge, the investment banks were given the incentive to take greater dangers, while minimizing the amount of equity they are needed to hold against any provided dollar of assets.

Even prior to its passage, investment banks were currently permitted to trade and hold the very financial properties at the center of the monetary crisis: mortgagebacked securities, derivatives, creditdefault swaps, collateralized debt commitments. The shift of financial investment banks into holding considerable trading portfolios arised from their increased capital base as an outcome of a lot of investment banks becoming openly held business, a structure enabled under GlassSteagall.

The How Often Do Underwriters Deny Mortgages Diaries

If a family member loans you numerous thousand dollars for your down payment and expects to be paid back, it could disrupt your capability to make your home loan payments. If you're preparing to utilize down payment gift cash when purchasing a home, ask your home loan loan provider about the particular requirements and standards in advance.

Do they require to offer a bank declaration too? A copy of the canceled check? Find out. The home mortgage deposit present letter itself is pretty straightforward. Ask your home mortgage loan provider if they have Click to find out more a favored format, or if they require any items beyond those listed above. Otherwise, you could just utilize a standard design template for your letter.

I do not expect or require any type of payment http://donovankvrc860.bearsfanteamshop.com/the-ultimate-guide-to-what-are-the-debt-to-income-ratios-for-mortgages for this gift. I wrote the check for these funds on February 1, 2019, and he deposited it the next day. Must you require to contact me regarding this contribution, you can do so using the info below: Seriously, Jeffrey Doe1234 Elm StreetAnytown, VA 24018( 123) 555-4459 As you can see, it does not have to be anything elegant.

It consists of the donor's name, his contact details, and his relationship to the house buyer. It mentions the quantity being talented ($ 7,000). It describes that there is no repayment requirement for the present amount-- the vital product. It's basic and straightforward. The lender will likely confirm that the gifted funds are in your account, early on at the same time.

The Main Principles Of What Is The Current Interest Rate On Reverse Mortgages

A bank statement will normally be sufficient for this function. The lender might likewise request a deposit slip, or a copy of the canceled check (the check written by the member of the family for the down-payment gift to you). The best-case scenario is to have the gifted funds in your own account long prior to the set up closing date.

But it's a lot much easier to deposit the check well beforehand. If you have any questions about this, be sure to ask your lender.

Mortgage Q&A: "What is a present letter?" A reader recently asked about mortgage gift letters, so instead of merely addressing their concern, I figured I 'd compose a whole post on the based on assist others better understand this topic. If you've been searching realty listings lately and have big plans to purchase a huge house, however your down payment isn't so huge, you might have heard that you can get a present for the deposit.

The exact same method may help you win a bidding war if the sellers aren't all that pleased with your 3% down payment. what is a gift letter for mortgages. Whatever the factor, you've got choices if you have a wealthy donor going to assist you out. But gifting money isn't without its own requirements. If you do not have your own down payment fundsIt's possible to get a present from a qualified donorSuch as a relative or domestic partnerThis choice is readily available on lots of different kinds of loans, but rules varyWhile mortgage underwriting requirements differ, most home loan lenders will enable you to use present cash for a deposit if you're acquiring an owner-occupied residential or commercial property, one you prepare to inhabit as your main house.

The What Is The Current Interest Rate On Reverse Mortgages Statements

Additionally, presents can be used in combination with all kinds of home loans, including conventional (Fannie Mae and Freddie Mac), FHA loans, and jumbo loans. Both USDA loans and VA loans currently allow 100% funding, however presents might still be offered to cover closing costs, or to cover any shortage in home assessment.

And it can even be utilized for property reserves, which when required, ask that you reserve X variety of months of PITI home loan payments to demonstrate your ability to pay back the loan. The takeaway here is that even if you can't get your hands on a no down mortgage, you may efficiently still have the ability to buy a house without any deposit if a donor is willing to assist you out.

Even if you are using present fundsSometimes you may need to generate your own moneyTo satisfy any minimum borrower contributionWhich shows the loan provider you have some skin in the video game as wellWhile it's frequently possible to get gift money for the down payment and closing costs, there is in some cases a minimum contribution required from the borrower's own funds.

If the house rate were $300,000, the customer would need a least $15,000 from their own checking account, and the gift funds could then complement the debtor's funds to cover any other costs like down payment, closing expenses, and reserves. One loophole is if the donor has been coping with the customer for the previous 12 months, or is from a fianc or fiance, then the gift funds can be considered the borrower's own funds even if they aren't.

The smart Trick of How Do Down Payments Work On Mortgages That Nobody is Talking About

If it's a 2nd home, you'll normally need at least 5% of the purchase cost to come from your own funds. Make certain to consider both the reputation of gift funds and any minimum contribution needed by the borrower to inspect all the boxes. One crucial caveat to gift cash is that it must come from an acceptable donor, not simply anybody prepared to offer you money.

In fact, it can even originate from your own child, assuming they're rolling in dough for some factor. Hop over to this website When it comes to government financing such as USDA loans, VA loans, and FHA loans, the borrower's company is likewise an appropriate source. As is a labor union, a charitable company, a government firm that offers homeownership assistance, and even a friend with a "clearly defined and recorded interest in the debtor." Alternatively, Fannie Mae and Freddie Mac don't allow presents from friends and employers, but borrowers might use donated present or grant funds from churches, towns, and nonprofit organizations (excluding cooperative credit union).

However, regardless of loan type your donor can't be an interested celebration to the deal, someone who stands to benefit by offering you the gift money. This includes the house seller, realty representatives, house contractors, property designers, and so on. Any temptation to purchase is restricted. Assuming you have an acceptable donor and an appropriate property type, and need some help in the way of closing funds, you'll need to procure a "home mortgage gift letter" along with any other loan conditions that need to be satisfied.

There are lots of sample gift letter templates on the web, generally offered by home loan lending institutions as a courtesy. You're likewise free to ask your loan officer or mortgage broker for assistance, and they'll probably have a kind readily offered. The dollar amount of the giftThe date the funds were transferredThe donor's contact informationThe donor's relationship to the borrowerA declaration from the donor that no repayment of the present is necessaryIt's beautiful uncomplicated.

More About What Is The Current Libor Rate For Mortgages

Keep in mind, it's called a giftSo that implies it is NOT a loanIn other words, it does not need to be paid backIf it did, it would need to be included in your liabilities and would minimize your buying powerMost importantly, you need to have the donor state that the funds are really a gift.

5 Easy Facts About What Were The Regulatory Consequences Of Bundling Mortgages Explained

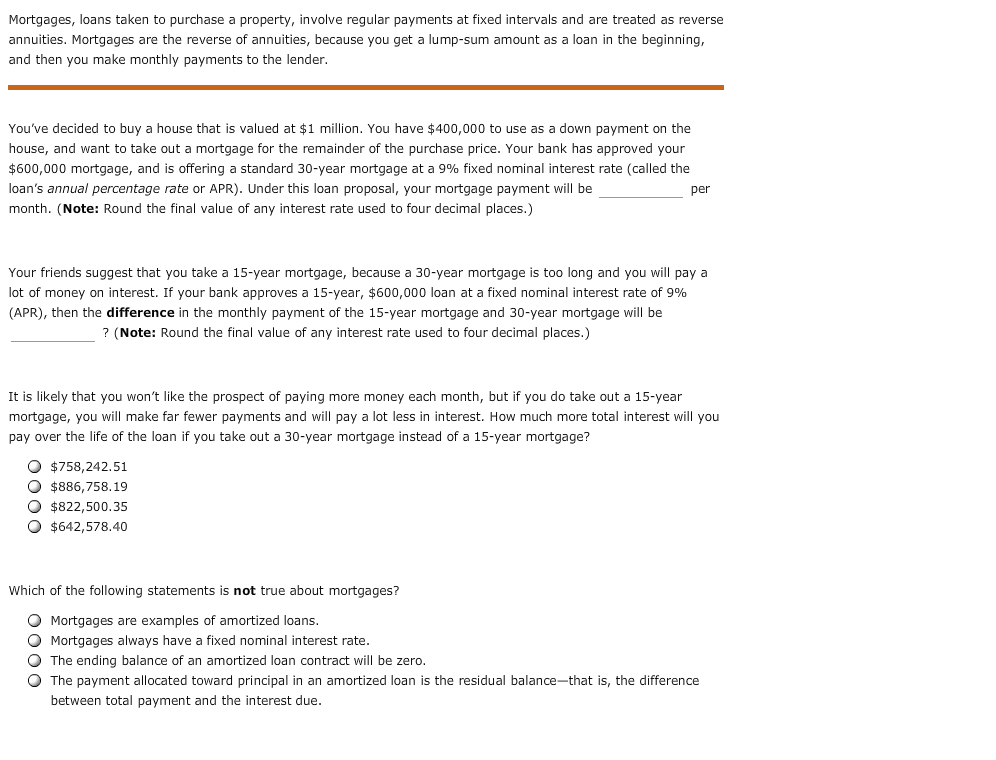

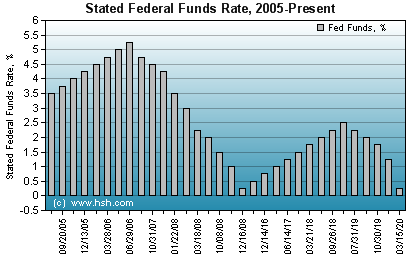

Mortgage payments are structured so that interest is paid off sooner, with the bulk of mortgage payments in the very first half of your home loan term approaching interest. As the loan amortizes, a growing number of of the mortgage payment approaches the principal and less towards its interest. Continue reading: Prior to you even request a home loan, you need to get preapproved. Once you sign, these become what you need to pay. With a fixed-rate home mortgage, your rates of interest remains the same throughout the life of the home loan. (Mortgages normally last for 15 or 30 years, and payments need to be made monthly.) While this indicates that your rate of interest can never go up, it also suggests that it might be greater on typical than an adjustable-rate home loan in time.

However, you generally get a certain variety of years at the beginning of the loan period throughout which the rate of interest is fixed. For example, if you have a 7/1 ARM, you get seven years at the fixed rate after which the rate can be adjusted when annually. This means your month-to-month mortgage payment might go up or down to represent changes to the interest rate.

If you're 62 or older and desire money to settle your home loan, supplement your income, or spend for healthcare expenses you might think about a reverse home loan. It enables you to convert part of the equity in your home into cash without needing to sell https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 your home or pay additional monthly costs.

A reverse home mortgage can utilize up the equity in your house, which suggests less possessions for you and your successors. If you do choose to try to find one, examine the different kinds of reverse home loans, and contrast shop prior to you decide on a specific business - how do commercial mortgages work. Continue reading for more information about how reverse home mortgages work, certifying for a reverse mortgage, getting the very best deal for you, and how to report any fraud you might see.

The Definitive Guide to How Do Mortgages Work For Income Properties

In a mortgage, you get a loan in which the lender pays you. Reverse home loans participate of the equity in your house and transform it into payments to you a sort of advance payment on your home equity. The cash you get normally is tax-free. Normally, you do not need to pay back the money for as long as you live in your house.

Sometimes that suggests selling the home to get cash to repay the loan. There are 3 kinds of reverse home mortgages: single function reverse mortgages provided by some state and regional government companies, as well as non-profits; exclusive reverse home loans personal loans; and federally-insured reverse home loans, also called House Equity Conversion Home Mortgages (HECMs).

You keep the title to your house. Rather of paying monthly home mortgage payments, though, you get an advance on part of your home equity (explain how mortgages work). The cash you get generally is not taxable, and it generally will not affect your Social Security or Medicare benefits. When the last making it through borrower passes away, offers the home, or no longer lives in the home as a primary home, the loan has to be repaid.

Here are some things to consider about reverse home mortgages:. Reverse home loan lenders generally charge an origination charge and other closing costs, in addition to maintenance charges over the life of the home mortgage. Some also charge home mortgage insurance coverage premiums (for federally-insured HECMs). As you get cash through your reverse home loan, interest is included onto the balance you owe each month.

5 Simple Techniques For How Do Mortgages Work When You Move

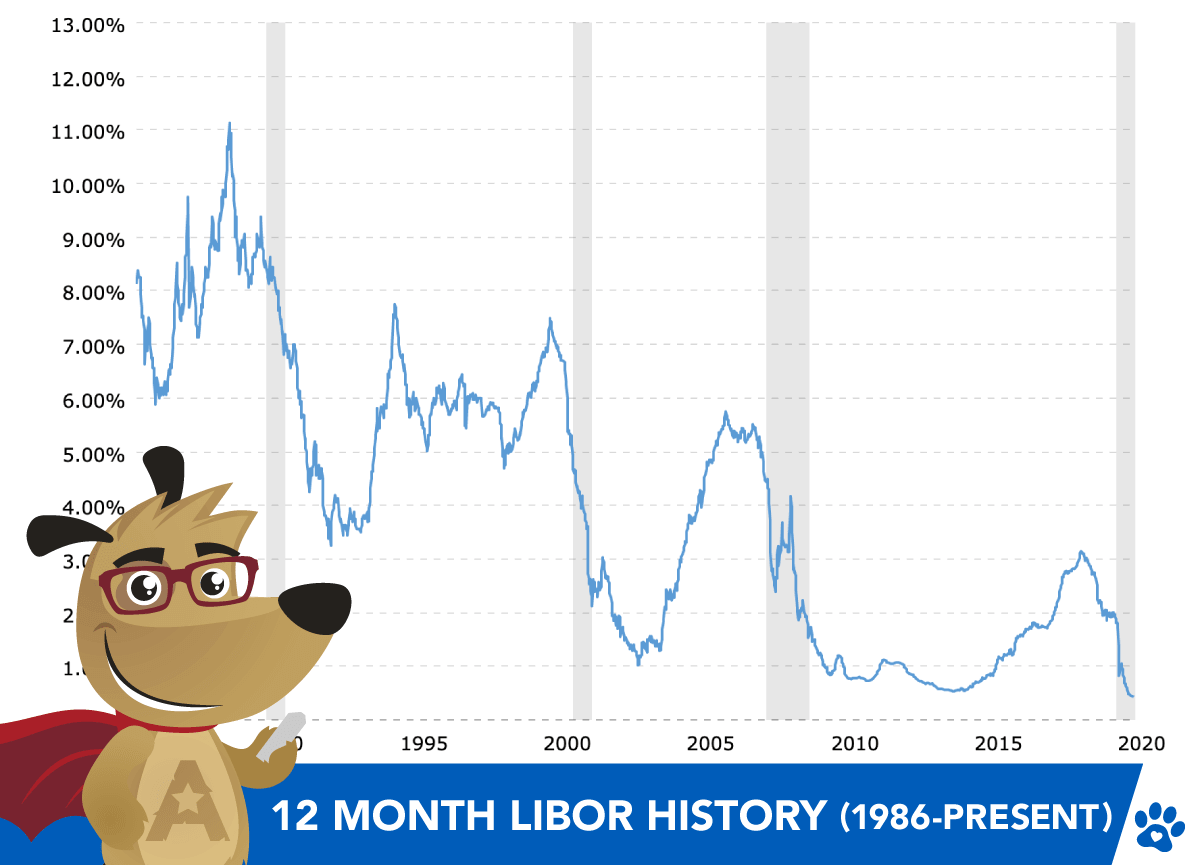

The majority of reverse mortgages have variable rates, which are tied to a monetary index and change with the marketplace. Variable rate loans tend to give you more choices on how you get your cash through the reverse mortgage. Some reverse home loans mainly HECMs provide repaired rates, but they tend to need you to take your loan as a lump sum at closing.

Interest on reverse home mortgages is not deductible on tax return up until the loan is settled, either partially or completely. In a reverse home mortgage, you keep the title to your home. That means you are accountable for real estate tax, insurance coverage, utilities, fuel, upkeep, and other expenses. And, if you don't pay your real estate tax, keep house owner's insurance, or keep your house, the loan provider may need you to repay your loan.

As an outcome, your loan provider may need a "set-aside" total up to pay your taxes and insurance during the loan. The "set-aside" reduces the amount of funds you can get in payments. You are still responsible for keeping your home. With HECM loans, if you signed the loan documentation and your spouse didn't, in certain circumstances, your spouse might continue to reside in the house even after you die if he or she pays taxes and insurance, and continues to maintain the home.

Reverse home mortgages can utilize up the equity in your house, which indicates fewer properties for you and your heirs. A lot of reverse home mortgages have something called a "non-recourse" provision. This means that you, or your estate, can't owe more than the worth of your house when the loan becomes due and the house is sold.

The 7-Second Trick For How Mortgages Work Bogleheads

As you think about whether a reverse home loan is right for you, likewise think about which of the three kinds of reverse mortgage may best fit your needs. are the least expensive choice. They're offered by some state and city government agencies, in addition to non-profit https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work companies, but they're not available all over.

For instance, the loan provider might state the loan may be utilized just to spend for home repair work, improvements, or real estate tax. A lot of homeowners with low or moderate income can get approved for these loans. are private loans that are backed by the companies that establish them. If you own a higher-valued home, you might get a larger loan advance from a proprietary reverse home loan.

are federally-insured reverse home mortgages and are backed by the U. S. Department of Housing and Urban Development (HUD). HECM loans can be utilized for any purpose. HECMs and proprietary reverse mortgages might be more pricey than traditional home loans, and the upfront expenses can be high. That is very important to think https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html about, particularly if you plan to remain in your home for simply a short time or obtain a percentage.

In basic, the older you are, the more equity you have in your home, and the less you owe on it, the more cash you can get. Prior to getting a HECM, you need to consult with a therapist from an independent government-approved housing therapy agency. Some lenders using proprietary reverse home mortgages likewise need counseling.

How Many Mortgages In Dallas Metroplex 2016 Fundamentals Explained

Mortgage payments are structured so that interest is settled https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 earlier, with the bulk of home loan payments in the very first half of your mortgage term going towards interest. As the loan amortizes, increasingly more of the mortgage payment goes toward the principal and less toward its interest. Continue reading: Prior to you even apply for a home loan, you have to get preapproved. When you sign, these become what you have to pay. With a fixed-rate home mortgage, your rate of interest remains the very same throughout the life of the mortgage. (Mortgages generally last for 15 or thirty years, and payments should be made monthly.) While this suggests that your rate of interest can never go up, it likewise suggests that it could be greater usually than an adjustable-rate home loan with time.

However, you generally get a certain variety of years at the beginning of the loan duration during which the rates of interest is repaired. For example, if you have a 7/1 ARM, you get 7 years at the repaired rate after which the rate can be adjusted once each year. This suggests your regular monthly home loan payment might increase or down to represent changes to the interest rate.

If you're 62 or older and desire money to pay off your home loan, supplement your earnings, or spend for health care expenditures you might think about a reverse home mortgage. It enables you to transform part of the equity in your home into money without having to sell your home or pay additional monthly expenses.

A reverse mortgage can consume the equity in your house, which means fewer properties for you and your heirs. If you do choose to try to find one, examine the various kinds of reverse home mortgages, and comparison shop prior to you choose a particular business - how do mortgages work in the us. Keep reading to find out more about how reverse home mortgages work, getting approved for a reverse home loan, getting the very best deal for you, and how to report any fraud you may see.

The Best Guide To How Do Uk Mortgages Work

In a home loan, you get a loan in which the lending institution pays you. Reverse home mortgages participate of the equity in your house and transform it into payments to you a kind of advance payment on your house equity. The cash you get normally is tax-free. Generally, you don't have to pay back the cash for as long as you reside in your house.

Often that implies offering the house to get money to pay back the loan. There are 3 kinds of reverse mortgages: single function reverse mortgages provided by some state and city government companies, in addition to non-profits; proprietary reverse mortgages private loans; and federally-insured reverse home loans, also called House Equity Conversion Home Mortgages (HECMs).

You keep the title to your house. Rather of paying monthly mortgage https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work payments, though, you get a bear down part of your house equity (how do assumable mortgages work). The money you get usually is not taxable, and it usually won't affect your Social Security or Medicare benefits. When the last enduring debtor passes away, offers the house, or no longer lives in the home as a primary home, the loan needs to be paid back.

Here are some things to consider about reverse home loans:. Reverse home loan lenders normally charge an origination charge and other closing costs, along with maintenance costs over the life of the mortgage. Some likewise charge mortgage insurance coverage premiums (for federally-insured HECMs). As you get money through your reverse home loan, interest is included onto the balance you owe every month.

The Greatest Guide To How Do Fannie Mae Mortgages Work

Most reverse home mortgages have variable rates, which are tied to a monetary index and modification with the marketplace. Variable rate loans tend to offer you more alternatives on how you get your money through the reverse home mortgage. Some reverse mortgages mostly HECMs provide repaired rates, however they tend to require you to take your loan as a swelling amount at closing.

Interest on reverse mortgages is not deductible on tax return up until the loan is paid off, either partially or completely. In a reverse mortgage, you keep the title to https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html your home. That indicates you are accountable for residential or commercial property taxes, insurance, energies, fuel, upkeep, and other costs. And, if you don't pay your home taxes, keep homeowner's insurance coverage, or preserve your home, the lender may require you to repay your loan.

As a result, your lender may require a "set-aside" total up to pay your taxes and insurance coverage throughout the loan. The "set-aside" minimizes the amount of funds you can get in payments. You are still responsible for maintaining your home. With HECM loans, if you signed the loan documents and your partner didn't, in certain circumstances, your spouse might continue to reside in the home even after you pass away if she or he pays taxes and insurance coverage, and continues to preserve the home.

Reverse home mortgages can consume the equity in your house, which means less possessions for you and your heirs. The majority of reverse mortgages have something called a "non-recourse" clause. This means that you, or your estate, can't owe more than the worth of your house when the loan becomes due and the home is sold.

Excitement About How Subprime Mortgages Work

As you think about whether a reverse home mortgage is best for you, also think about which of the three types of reverse home mortgage may finest fit your requirements. are the least pricey choice. They're provided by some state and city government companies, in addition to non-profit companies, however they're not readily available everywhere.

For example, the lender might state the loan might be used just to pay for house repairs, enhancements, or real estate tax. Most property owners with low or moderate earnings can receive these loans. are personal loans that are backed by the business that establish them. If you own a higher-valued house, you might get a larger loan advance from a proprietary reverse home loan.

are federally-insured reverse home mortgages and are backed by the U. S. Department of Housing and Urban Advancement (HUD). HECM loans can be used for any function. HECMs and exclusive reverse mortgages may be more expensive than standard mortgage, and the upfront expenses can be high. That's important to think about, particularly if you prepare to remain in your house for just a brief time or borrow a little amount.

In general, the older you are, the more equity you have in your house, and the less you owe on it, the more money you can get. Prior to requesting a HECM, you must consult with a therapist from an independent government-approved real estate counseling company. Some loan providers offering exclusive reverse home mortgages likewise need therapy.

Things about How Many Mortgages Can You Have With Freddie Mac

Home loan payments are structured so that interest is settled faster, with the bulk of home mortgage payments in the first half of your home mortgage term going toward interest. As the loan amortizes, a growing number of of the mortgage payment goes toward the principal and less toward its interest. Check out on: Before you even get a mortgage, you have to get preapproved. Once you sign, these become what you have to pay. With a fixed-rate home loan, your interest rate stays the very same throughout the life of the home loan. (Home loans generally last for 15 or 30 years, and payments should be made month-to-month.) While this means that your interest rate can never go up, it also implies that it might be higher on typical than an adjustable-rate home mortgage in time.

However, you usually get a certain variety of years at the start of the loan duration throughout which the rates of interest is fixed. For example, if you have a 7/1 ARM, you get seven years at the repaired rate after which the rate can be adjusted as soon as annually. This implies your regular monthly home loan payment might increase or down to account for changes to the interest rate.

If you're 62 https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work or older and want cash to settle your home mortgage, supplement your earnings, or spend for healthcare expenditures you might consider a reverse home loan. It enables you to transform part of the equity in your home into money https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 without needing to offer your home or pay extra regular monthly bills.

A reverse home mortgage can consume the equity in your home, which implies less assets for you and your successors. If you do decide to search for one, review the various types of reverse mortgages, and comparison store prior to you choose a specific company - how do reverse mortgages work in florida. Keep reading to find out more about how reverse home loans work, receiving a reverse mortgage, getting the best deal for you, and how to report any fraud you may see.

Unknown Facts About How Do Uk Mortgages Work

In a home loan, you get a loan in which the lender pays you. Reverse home mortgages take part of the equity in your house and convert it into payments to you a kind of advance payment on your house equity. The cash you get typically is tax-free. Normally, you do not have to pay back the cash for as long as you live in your home.

In some cases that suggests selling the home to get cash to pay back the loan. There are three kinds of reverse home loans: single purpose reverse mortgages used by some state and city government firms, in addition to non-profits; proprietary reverse home loans personal loans; and federally-insured reverse home loans, likewise referred to as Home Equity Conversion Mortgages (HECMs).

You keep the title to your house. Instead of paying regular monthly home loan payments, though, you get an advance on part of your home equity (reverse mortgages how do they work). The money you get usually is not taxable, and it normally will not impact your Social Security or Medicare advantages. When the last surviving debtor dies, sells the house, or no longer lives in the home as a principal residence, the https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html loan needs to be repaid.

Here are some things to consider about reverse home mortgages:. Reverse home loan lending institutions usually charge an origination cost and other closing expenses, along with servicing charges over the life of the mortgage. Some likewise charge mortgage insurance coverage premiums (for federally-insured HECMs). As you get cash through your reverse home mortgage, interest is added onto the balance you owe monthly.

How Mortgages Work Bogleheads Things To Know Before You Get This

A lot of reverse home loans have variable rates, which are tied to a financial index and modification with the market. Variable rate loans tend to give you more options on how you get your money through the reverse mortgage. Some reverse mortgages mainly HECMs use fixed rates, but they tend to need you to take your loan as a lump sum at closing.

Interest on reverse home loans is not deductible on tax return till the loan is settled, either partially or in full. In a reverse home mortgage, you keep the title to your house. That suggests you are accountable for real estate tax, insurance coverage, energies, fuel, upkeep, and other expenses. And, if you don't pay your real estate tax, keep property owner's insurance, or preserve your house, the loan provider might need you to repay your loan.

As an outcome, your loan provider might require a "set-aside" total up to pay your taxes and insurance during the loan. The "set-aside" minimizes the quantity of funds you can get in payments. You are still accountable for keeping your house. With HECM loans, if you signed the loan documents and your spouse didn't, in specific situations, your spouse might continue to reside in the house even after you pass away if she or he pays taxes and insurance coverage, and continues to preserve the property.

:max_bytes(150000):strip_icc()/RocketMortgagebyQuickenLoans-5be313024cedfd0026fcc207.jpg)

Reverse home loans can consume the equity in your house, which means less possessions for you and your heirs. Many reverse mortgages have something called a "non-recourse" clause. This indicates that you, or your estate, can't owe more than the worth of your home when the loan ends up being due and the house is offered.

How Doe Reverse Mortgages Work? Things To Know Before You Buy

As you consider whether a reverse home mortgage is best for you, likewise consider which of the three kinds of reverse home mortgage might finest match your needs. are the least expensive option. They're used by some state and local government agencies, in addition to non-profit organizations, however they're not offered everywhere.

For example, the lender may say the loan might be utilized only to pay for home repairs, improvements, or real estate tax. Most homeowners with low or moderate earnings can qualify for these loans. are personal loans that are backed by the business that establish them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse home loan.

are federally-insured reverse mortgages and are backed by the U. S. Department of Real Estate and Urban Development (HUD). HECM loans can be used for any function. HECMs and proprietary reverse mortgages may be more pricey than traditional home mortgage, and the upfront expenses can be high. That is necessary to consider, specifically if you prepare to stay in your house for just a short time or borrow a percentage.

In basic, the older you are, the more equity you have in your home, and the less you owe on it, the more cash you can get. Before using for a HECM, you must consult with a therapist from an independent government-approved real estate therapy company. Some lending institutions providing proprietary reverse home loans likewise require counseling.

The 2-Minute Rule for How Do Owner Financing Mortgages Work

Although a point lowers your interest rate by 0. 25%, there might be options that will give you a better return on your financial investment. Let's take an appearance at what else you can do with $5,000 (reverse mortgages how do they work). High-yield savings accounts have couple of overhead costs, you can access your cash whenever you need it, and you can earn relatively high-interest rates at lots of online banks.

05%. Expect you took $5,000 used in the example above and put it in a high-yield cost savings with a 1. 05% rates of interest. Assuming the rate does not alter, you would make $525 over 10 years, or $1,840 over 30 years. CDs are relatively risk-free investments using higher yields than some other low-risk investments.

10%. Instead of purchasing 2 points for $5,000 at closing, you'll earn an overall of about $64 annually Go to this website with your CD. After 30 years, your investment would equal $6,942 (deposit plus interest). That's presuming APY on CDs remains at 1. 10%, and you make no extra deposits into your CD during that period.

You will not "get abundant fast" with most investments, however rather grow your money in time. There is likewise the threat you'll lose your cash if not invested wisely. The most commonly recommended way to put your cash into the stock market by means of a retirement account such as a 401( k) or Roth Individual Retirement Account.

The typical annual return with a 401( k) is between 5% and 8%. This, of course, depends on the marketplaces and which financial investments you pick. Let's say you invested $5,000 in a 401( k), with a 6% rate of return. By year 30 you might be taking a look at a $28,000 balance. "An alternative to paying indicate buy the rate down is to think about shorter-term loan programs," says Eric Jeanette, owner of Dream House Funding and FHA Lenders, online education sites that provide solutions in different mortgage programs and lending options.

01% compared to a 30-year fixed APY of 3. 42%. You can see a distinction of 0. 41%, which is comparable to purchasing 2 points off the 30-year 3. 43% rate. Instead of spending $5,000 to see the exact same rate decrease, you could select the 15-year instead of the 30-year.

However, you will pay less in out-of-pocket interest without having to buy it with points. "The function of paying mortgage points is to pay a swelling amount upfront to decrease your future monthly payments," states Caleb Liu, owner of House Merely Offered, an L.A (how do business mortgages work). based realty solutions service. "You can achieve a similar, although not equivalent outcome by rerouting the quantity earmarked for mortgage points toward a somewhat greater down payment.

All about How Arm Mortgages Work

It's likewise worth keeping in mind home mortgage points are tax-deductible if you meet the IRS requirements. Lastly, note that buying a home means setting yourself up for the bevy of costs that include owning a home, from taxes to repairs. You'll need to have enough cash to make a down payment, cover closing expenses (which can equal 2 to 5% of your purchase cost) and have sufficient cost savings remaining to get you through any emergency situations or loss of income.

Before you decide, compare westley baker your options with other investment opportunities. We discover buying your retirement and 401( k) can see the very best rewards. The substance interest on $5,000 does not included any strings attached compared to buying points. Meaning, it's not depending on whether or not you move, refinance, or have the discipline to save the $68 distinction every month.

To choose on your own if mortgage points are worth it, ask yourself if you can pay for the expense of and all other closing costs. Determine if you're planning to be in your house long enough to recoup the cost of home mortgage points. Just then will you feel great to choose if discount rate points deserve it.

Home mortgage points can save you cash, however just if you prepare on remaining in your home for a number of years. (iStock) As home loan rates continue to sit at traditionally low-interest rates, cancel siriusxm radio potential purchasers have the possibility to conserve thousands of dollars on their house purchase. You can benefit from the low rates to refinance your home loan too to reduce your monthly payments.

Saving money in the long run is a major factor home purchasers might do this. Mortgage points allow borrowers to buy lower rate of interest on their home mortgage by paying an upfront fee. Online market Trustworthy can assist you compare mortgage business and browse the documentation whenever you're prepared. If you anticipate remaining in your house for several years and don't plan to refinance your home mortgage for a while, acquiring points could be a cost-saving choice.

2 kinds of home mortgage points apply to brand-new purchases and home refinances. use to all loans and include charges for administering and processing the loans. reverse mortgages how do they work. Some mortgage loan providers charge a flat rate, some charge a portion of the loan overall. describe charges that home loan loan providers credit enable borrowers to lower the rates of interest on their loan.

If you're considering acquiring a brand-new house, or wish to refinance your home loan, use Reputable to get in touch with experienced home mortgage loan providers to compare accounts, including rates, points' worth and expenses. Home mortgage points permit borrowers to lower the interest rate on the life of their loan by either spending for the points upfront or rolling the additional expense into the loan overall.

Indicators on How Do Negative Interest Rate Mortgages Work You Should Know

Customers can generally purchase one to 3 percent of the overall principal. Each point is worth one percent of the entire loan. For instance, one point on a $400,000 mortgage would equate to $4,000. Each point you buy lowers the rates of interest by about. 25 percent.The Federal Trade Commission recommends asking your loan provider to quote a dollar quantity versus a point quote, so you understand just how much you'll need to pay prior to committing.

Discover what kind of home mortgage refinance rates you receive today. Maybe. If you can afford to pay for the points upfront and plan to keep the house for numerous years, then you ought to buy home mortgage points. Preferably, you desire to at least break after buying points. As an example, let's consider a $400,000 loan funded for 30 years at a 5 percent rates of interest.

If you bought 2 points, it would cost you around $8,000 and lower your rates of interest to 4. 5 percent. You would pay $2,026 monthly (a cost savings of $120. 55 each month). You would need to own the house for at least 49 months to break even, and you might possibly conserve more than $43,000 in interest over the life of your loan.

To start conserving cash, you need to remain in the home longer. This calculation presumes you can pay for the points in advance and do not roll them into your loan expense. If you funded these same points, you would need to reside in the home for 119 months (practically 10 years) to break even.

How Do Interest Rates Work On Mortgages Loans Fundamentals Explained

Although a point lowers your interest rate by 0. 25%, there may be alternatives that will offer you a much better return on your investment. Let's take a look at what else you can do with $5,000 (how reverse mortgages work). High-yield cost savings accounts have few overhead costs, you can access your cash whenever you require it, and you can earn fairly high-interest rates at lots of online banks.

05%. Suppose you took $5,000 used in the example above and put it in a high-yield savings with a 1. 05% interest rate. Presuming the rate does not alter, you would make $525 over ten years, or $1,840 over 30 years. CDs are reasonably risk-free investments providing greater yields than some other low-risk financial investments.

10%. Rather than buying 2 points for $5,000 at closing, you'll make an overall of about $64 each year with your CD. After 30 years, your financial investment would equal $6,942 (deposit plus interest). That's assuming APY on CDs stays at 1. 10%, and you make no extra deposits into your CD throughout that period.

You will not "get rich fast" with the majority of investments, but rather grow your money over time. There is also the risk you'll lose your cash if not invested wisely. The most typically suggested way to put your money into the stock exchange through a retirement account such as a 401( k) or Roth IRA.

The average annual return with a 401( k) is in between 5% and 8%. This, obviously, depends upon the markets and which financial investments you choose. Let's state you invested $5,000 in a 401( k), with a 6% rate of return. By year 30 you might be looking at a $28,000 balance. "An option to paying indicate purchase the rate down is to consider shorter-term loan programs," states Eric Jeanette, owner of Dream Home Financing and FHA Lenders, online education websites that use options in numerous home loan programs and lending options.

01% compared to a 30-year set APY of 3. 42%. You can see a distinction of 0. 41%, which is comparable to purchasing two points off the 30-year 3. 43% rate. Instead of investing $5,000 to see the exact same rate reduction, you could go with the 15-year instead of the 30-year.

However, you will pay less in out-of-pocket interest without having to purchase it with points. "The purpose of paying mortgage points is to pay a lump amount upfront to lower your future monthly payments," states Caleb Liu, owner of Home Simply Offered, an L.A (how do mortgages payments work). based realty solutions service. "You can achieve a similar, although not equal outcome by redirecting the quantity earmarked for mortgage points towards a slightly greater down payment.

The Ultimate Guide To How Do Go to this website Rocket Mortgages Work?

It's likewise worth noting home loan points are tax-deductible if you fulfill the Internal Revenue Service requirements. Lastly, note that purchasing a house suggests setting yourself up for the bevy of costs that feature owning a home, from taxes to repairs. You'll need to have adequate cash to make a deposit, cover closing costs (which can equal 2 to 5% of your purchase rate) and have adequate savings remaining to get you through any emergencies or loss of income.

Before you decide, compare your options with other investment chances. We discover purchasing your retirement and 401( k) can see the finest rewards. The compound interest on $5,000 does not featured any strings attached compared to purchasing points. Significance, it's not based on whether or not you move, re-finance, or have the discipline to save the $68 difference every month.

To decide for yourself if home mortgage points are worth it, ask yourself if you can afford the expense of and all other closing expenses. Identify if you're planning to be in your house long enough to recoup the cost of home loan points. Just then will you feel great to choose if discount rate points are worth it.

Home mortgage points can conserve you money, however just if you prepare on remaining in your home for numerous years. (iStock) As mortgage rates continue to sit at traditionally low-interest rates, potential buyers have the chance to conserve thousands of dollars on their house purchase. You can benefit from the low rates to re-finance your home loan as well cancel siriusxm radio to reduce your regular monthly payments.

Saving cash in the long run is a significant factor house purchasers may do this. Home mortgage points allow customers to purchase lower rate of interest on their home loan by paying an in advance charge. Online marketplace Reliable can assist you compare home mortgage business and browse the paperwork whenever you're prepared. If you expect staying in your house for numerous years and do not plan to refinance your mortgage for a while, acquiring points could be a cost-saving choice.

2 kinds of mortgage points apply to new purchases and house refinances. use to all loans and consist of charges for administering and processing the loans. how do mortgages work when building a home. Some mortgage lending institutions charge a flat rate, some charge a portion of the loan overall. refer to costs that home loan loan providers charge to permit debtors to decrease the interest rate on their loan.

If you're considering buying a brand-new house, or wish to re-finance your mortgage, use Reputable to get in touch with skilled home loan loan providers to compare accounts, including rates, points' worth and expenses. Home loan points allow debtors to lower the rate of interest on the life of their loan by either spending for the points upfront or rolling the additional cost into the loan total.

How Mortgages Work Pay Interest First Can Be Fun For Everyone

Borrowers can normally purchase one to three westley baker percent of the overall principal. Each point is worth one percent of the entire loan. For example, one point on a $400,000 home mortgage would equal $4,000. Each point you purchase reduces the interest rate by about. 25 percent.The Federal Trade Commission recommends asking your lending institution to estimate a dollar amount versus a point quote, so you understand just how much you'll need to pay prior to committing.

Discover what sort of mortgage refinance rates you get approved for today. Perhaps. If you can pay for to pay for the points upfront and plan to keep the house for several years, then you should buy home mortgage points. Preferably, you desire to at least break after purchasing points. As an example, let's think about a $400,000 loan financed for 30 years at a 5 percent rate of interest.

If you purchased 2 points, it would cost you around $8,000 and lower your rates of interest to 4. 5 percent. You would pay $2,026 per month (a cost savings of $120. 55 per month). You would require to own the house for a minimum of 49 months to break even, and you might potentially conserve more than $43,000 in interest over the life of your loan.

To begin conserving cash, you ought to remain in the house longer. This calculation assumes you can pay for the points upfront and don't roll them into your loan cost. If you funded these very same points, you would require to live in the home for 119 months (nearly ten years) to break even.

Our How Do Reverse Mortgages Work Dave Ramsey Statements

Although a point decreases your interest rate by 0. 25%, there might be alternatives that will give you a better return on your investment. Let's take a look at what else you can do with $5,000 (how to reverse mortgages work). High-yield savings accounts have few overhead costs, you can access your money whenever you need it, and you can make relatively high-interest rates at numerous online banks.

05%. Suppose you took $5,000 used in the example above and put it in a high-yield cost savings with a 1. 05% interest rate. Presuming the rate does not alter, you would make $525 over 10 years, or $1,840 over 30 years. CDs are reasonably safe investments using higher yields than some other low-risk investments.

10%. Rather than purchasing 2 points for $5,000 at closing, you'll earn a total of about $64 per year with your CD. After thirty years, your investment would equate to $6,942 (deposit plus interest). That's presuming APY on CDs remains at 1. 10%, and you make no additional deposits into your CD throughout that period.

You won't "get abundant fast" with many investments, however rather grow your cash gradually. There is likewise the risk you'll lose your money if not invested wisely. The most frequently recommended method to put your money into the stock market through a pension such as a 401( k) or Roth Individual Retirement Account.

The typical yearly cancel siriusxm radio return with a 401( k) is between 5% and 8%. This, obviously, depends on the marketplaces and which investments you choose. Let's state you invested $5,000 in a 401( k), with a 6% rate of return. By year 30 you might be taking a look at a $28,000 balance. "An option to paying points to buy the rate down is to consider shorter-term loan programs," states Eric Jeanette, owner of Dream House Funding and FHA Lenders, online education websites that provide services in various home mortgage programs and lending options.

01% compared to a 30-year fixed APY of 3. 42%. You can see a difference of 0. 41%, which is equivalent to purchasing 2 points off the 30-year 3. 43% rate. Instead of investing $5,000 to Go to this website see the exact same rate reduction, you could choose the 15-year instead of the 30-year.

However, you will pay less in out-of-pocket interest without needing to purchase it with points. "The function of paying mortgage points is to pay a lump sum upfront to decrease your future regular monthly payments," says Caleb Liu, owner of Home Merely Offered, an L.A (how do commercial mortgages work). based genuine estate solutions service. "You can attain a comparable, although not equal outcome by redirecting the amount earmarked for home loan points toward a somewhat higher deposit.

Not known Facts About How Do Reverse Mortgages Work Example

It's also worth noting mortgage points are tax-deductible if you satisfy the IRS requirements. Lastly, note that purchasing a home implies setting yourself up for the bevy of expenses that include owning a property, from taxes to repairs. You'll need to have enough cash to make a down payment, cover closing costs (which can equate to 2 to 5% of your purchase rate) and have adequate savings remaining to get you through any emergency situations or loss of earnings.

Prior to you choose, compare your choices with other investment chances. We find investing in your retirement and 401( k) can see the finest benefits. The substance interest on $5,000 does not included any strings attached compared to purchasing points. Meaning, it's not depending on whether you move, re-finance, or have the discipline to save the $68 difference each month.

To choose for yourself if mortgage points are worth it, ask yourself if you can manage the expense of and all other closing costs. Identify if you're planning to be in your house enough time to recover the expense of mortgage points. Only then will you feel great to decide if discount points are worth it.

Mortgage points can conserve you cash, but just if you intend on remaining in your home for a number of years. (iStock) As mortgage rates continue to sit at historically low-interest rates, possible buyers have the chance to conserve countless dollars on their home purchase. You can make the most of the low rates to re-finance your home mortgage too to decrease your month-to-month payments.

Saving cash in the long run is a significant factor house purchasers might do this. Mortgage points enable customers to purchase lower rates of interest on their home loan by paying an upfront charge. Online market Trustworthy can help you compare home loan business and navigate the documentation whenever you're all set. If you anticipate staying in your home for several years and don't plan to re-finance your home mortgage for a while, acquiring points might be a cost-saving choice.

2 types of home loan points apply to brand-new purchases and home refinances. apply to all loans and include costs for administering and processing the loans. how do bad credit mortgages work. Some home mortgage lenders charge a flat rate, some charge a portion of the loan overall. refer to fees that home loan loan providers credit allow borrowers to reduce the rate of interest on their loan.

If you're considering acquiring a brand-new house, or desire to refinance your home mortgage, usage Trustworthy to link with experienced mortgage lending institutions to compare accounts, including rates, points' worth and costs. Home loan points allow debtors to minimize the rates of interest on the life of their loan by either paying for the points upfront or rolling the extra cost into the loan overall.

Not known Details About How Do Canadian Mortgages Work?

Customers can typically buy one to three percent of the total principal. Each point is worth one percent of the entire loan. For instance, one point on a $400,000 home loan would equal $4,000. Each point you buy decreases the interest rate by about. 25 percent.The Federal Trade Commission suggests asking your lender to price quote a dollar amount versus a point quote, so you know just how much you'll have to pay before devoting.

Learn what type of home mortgage refinance rates you qualify for today. Perhaps. If you can afford to pay for the points upfront and mean to keep the house for numerous years, then you ought to purchase home loan points. Preferably, you desire to at least break after purchasing points. As an example, let's consider a $400,000 loan financed for thirty years at a 5 percent interest rate.

If you bought 2 points, it would cost you around $8,000 and lower your interest rate to 4. 5 percent. You would pay $2,026 per month (a savings of $120. 55 each month). You would need to own the home for a minimum of 49 months to break even, and you might possibly save more than $43,000 in interest over the life of your loan.

To begin conserving cash, you need to remain in the home longer. This calculation presumes you can spend for the points upfront and don't roll them into your loan expense. If you westley baker funded these very same points, you would require to live in the residential or commercial property for 119 months (practically ten years) to break even.

Facts About What Is The Going Interest Rate On Mortgages Uncovered

There are exceptions, however. If you're thinking about a reverse mortgage, search. Choose which kind of reverse home loan may be ideal for you. That might depend on what you wish to make with the money. Compare the alternatives, terms, and costs from different lenders. Discover as much as you can about reverse home loans before you talk with a therapist or loan provider.

Here are some things to consider: If so, learn if you receive any inexpensive single function loans in your area. Personnel at your local Location Agency on Aging may understand about the programs in your area. Find the nearby agency on aging at eldercare. gov, or call 1-800-677-1116.

You might be able to obtain more cash with a proprietary reverse home loan. But the more you borrow, the higher the fees you'll pay. You likewise might consider a HECM loan - how do reverse mortgages work?. A HECM counselor or a lending institution can assist you compare these kinds of loans side by side, to see what you'll get and what it costs.

Little Known Facts About How Do Arms Work For Mortgages.

While the home loan insurance premium is usually the exact same from lending institution to lender, the majority of loan expenses consisting of origination charges, rates of interest, closing expenses, and servicing charges differ amongst lenders. Ask a therapist or lender to describe the Total Annual Loan Cost (TALC) rates: they show the predicted annual typical expense of a reverse home mortgage, including all the itemized costs.

Is a reverse home loan right for you? Only you can choose what works for your scenario. A therapist from an independent government-approved real estate counseling firm can assist. But a sales representative isn't most likely to be the finest guide for what works for you. This is specifically true if he or she acts like a reverse mortgage is a solution for all your issues, pushes you to secure a loan, or has concepts on how you can spend the cash from a reverse home loan.

If you choose you require home enhancements, and you believe a reverse mortgage is the way to pay for them, search before selecting a specific seller. Your house enhancement expenses include not only the price of the work being done but also the costs and charges you'll pay to get the reverse home loan.

Getting The How Mortgages Subsidy Work To Work

Resist that pressure. If you buy those sort of financial items, you could lose the cash you obtain from your reverse home mortgage. You don't need to purchase any monetary items, services or investment to get a reverse home mortgage. In truth, in some situations, it's unlawful to require you to purchase Click to find out more other products to get a reverse home mortgage - how does chapter 13 work with mortgages.

Stop and contact a counselor or somebody you trust prior to you sign anything. A reverse home loan can be complicated, and isn't something to hurry into. The bottom line: If you do not understand the expense or functions of a reverse home loan, walk away. If you wikipedia timeshare feel pressure or urgency to finish the deal leave.

With the majority of reverse mortgages, you have at least 3 organization days after near to cancel the deal for any reason, without penalty. This is known as your right of "rescission." To cancel, you need to alert the lender in writing. Send your letter by licensed mail, and request a return invoice.

How Do Biweekly Mortgages Work Things To Know Before You Buy

Keep copies of your correspondence and any enclosures. After you cancel, the lender has 20 days to return any cash you have actually paid http://andytuow910.unblog.fr/2020/11/13/not-known-details-about-what-are-the-best-banks-for-mortgages/ for the financing. If you suspect a scam, or that someone associated with the deal may be breaking the law, let the counselor, loan provider, or loan servicer know.

Whether a reverse home loan is ideal for you is a big concern. Think about all your choices. You may receive less pricey options. The following companies have more info: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

In a word, a reverse mortgage is a loan. A property owner who is 62 or older and has significant home equity can borrow versus the value of their house and get funds as a swelling sum, repaired monthly payment or line of credit. Unlike a forward mortgagethe type utilized to buy a homea reverse mortgage does not need the homeowner to make any loan payments.

The Facts About How Do Biweekly Mortgages Work Revealed