The 2-Minute Rule for How Do Owner Financing Mortgages Work

Although a point lowers your interest rate by 0. 25%, there might be options that will give you a better return on your financial investment. Let's take an appearance at what else you can do with $5,000 (reverse mortgages how do they work). High-yield savings accounts have couple of overhead costs, you can access your cash whenever you need it, and you can earn relatively high-interest rates at lots of online banks.

05%. Expect you took $5,000 used in the example above and put it in a high-yield cost savings with a 1. 05% rates of interest. Assuming the rate does not alter, you would make $525 over 10 years, or $1,840 over 30 years. CDs are relatively risk-free investments using higher yields than some other low-risk investments.

10%. Instead of purchasing 2 points for $5,000 at closing, you'll earn an overall of about $64 annually Go to this website with your CD. After 30 years, your investment would equal $6,942 (deposit plus interest). That's presuming APY on CDs remains at 1. 10%, and you make no extra deposits into your CD during that period.

You will not "get abundant fast" with most investments, however rather grow your money in time. There is likewise the threat you'll lose your cash if not invested wisely. The most commonly recommended way to put your cash into the stock market by means of a retirement account such as a 401( k) or Roth Individual Retirement Account.

The typical annual return with a 401( k) is between 5% and 8%. This, of course, depends on the marketplaces and which financial investments you pick. Let's say you invested $5,000 in a 401( k), with a 6% rate of return. By year 30 you might be taking a look at a $28,000 balance. "An alternative to paying indicate buy the rate down is to think about shorter-term loan programs," says Eric Jeanette, owner of Dream House Funding and FHA Lenders, online education sites that provide solutions in different mortgage programs and lending options.

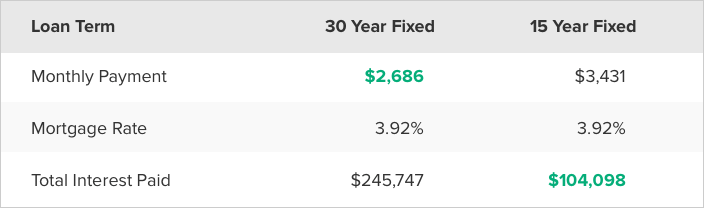

01% compared to a 30-year fixed APY of 3. 42%. You can see a distinction of 0. 41%, which is comparable to purchasing 2 points off the 30-year 3. 43% rate. Instead of spending $5,000 to see the exact same rate decrease, you could select the 15-year instead of the 30-year.

However, you will pay less in out-of-pocket interest without having to buy it with points. "The function of paying mortgage points is to pay a swelling amount upfront to decrease your future monthly payments," states Caleb Liu, owner of House Merely Offered, an L.A (how do business mortgages work). based realty solutions service. "You can achieve a similar, although not equivalent outcome by rerouting the quantity earmarked for mortgage points toward a somewhat greater down payment.

All about How Arm Mortgages Work

It's likewise worth keeping in mind home mortgage points are tax-deductible if you meet the IRS requirements. Lastly, note that buying a home means setting yourself up for the bevy of costs that include owning a home, from taxes to repairs. You'll need to have enough cash to make a down payment, cover closing expenses (which can equal 2 to 5% of your purchase cost) and have sufficient cost savings remaining to get you through any emergency situations or loss of income.

Before you decide, compare westley baker your options with other investment opportunities. We discover buying your retirement and 401( k) can see the very best rewards. The substance interest on $5,000 does not included any strings attached compared to buying points. Meaning, it's not depending on whether or not you move, refinance, or have the discipline to save the $68 distinction every month.

To choose on your own if mortgage points are worth it, ask yourself if you can pay for the expense of and all other closing costs. Determine if you're planning to be in your house long enough to recoup the cost of home mortgage points. Just then will you feel great to choose if discount rate points deserve it.

Home mortgage points can save you cash, however just if you prepare on remaining in your home for a number of years. (iStock) As home loan rates continue to sit at traditionally low-interest rates, cancel siriusxm radio potential purchasers have the possibility to conserve thousands of dollars on their house purchase. You can benefit from the low rates to refinance your home loan too to reduce your monthly payments.

Saving money in the long run is a major factor home purchasers might do this. Mortgage points allow borrowers to buy lower rate of interest on their home mortgage by paying an upfront fee. Online market Trustworthy can assist you compare mortgage business and browse the documentation whenever you're prepared. If you anticipate remaining in your house for several years and don't plan to refinance your home mortgage for a while, acquiring points could be a cost-saving choice.

2 kinds of home mortgage points apply to brand-new purchases and home refinances. use to all loans and include charges for administering and processing the loans. reverse mortgages how do they work. Some mortgage loan providers charge a flat rate, some charge a portion of the loan overall. describe charges that home loan loan providers credit enable borrowers to lower the rates of interest on their loan.

If you're considering acquiring a brand-new house, or wish to refinance your home loan, use Reputable to get in touch with experienced home mortgage loan providers to compare accounts, including rates, points' worth and expenses. Home mortgage points permit borrowers to lower the interest rate on the life of their loan by either spending for the points upfront or rolling the additional expense into the loan overall.

Indicators on How Do Negative Interest Rate Mortgages Work You Should Know

Customers can generally purchase one to 3 percent of the overall principal. Each point is worth one percent of the entire loan. For instance, one point on a $400,000 mortgage would equate to $4,000. Each point you buy lowers the rates of interest by about. 25 percent.The Federal Trade Commission recommends asking your loan provider to quote a dollar quantity versus a point quote, so you understand just how much you'll need to pay prior to committing.

Discover what kind of home mortgage refinance rates you receive today. Maybe. If you can afford to pay for the points upfront and plan to keep the house for numerous years, then you ought to buy home mortgage points. Preferably, you desire to at least break after buying points. As an example, let's consider a $400,000 loan funded for 30 years at a 5 percent rates of interest.

If you bought 2 points, it would cost you around $8,000 and lower your rates of interest to 4. 5 percent. You would pay $2,026 monthly (a cost savings of $120. 55 each month). You would need to own the house for at least 49 months to break even, and you might possibly conserve more than $43,000 in interest over the life of your loan.

To start conserving cash, you need to remain in the home longer. This calculation presumes you can pay for the points in advance and do not roll them into your loan expense. If you funded these same points, you would need to reside in the home for 119 months (practically 10 years) to break even.